AUGUSTA — A top aide to Gov. Paul LePage is losing five buildings — including one destroyed by arson last week — to foreclosure.

Savings Bank of Maine wants judgment by default on property owned by Dan Demeritt, of Sidney, the governor’s director of communications and legislative affairs.

Demeritt describes himself on the Maine government website as a landlord and small business owner.

There was no response filed to any of the court cases, but Demeritt said Thursday he isn’t ignoring the foreclosure notices.

“I didn’t file an answer because I am working directly with the bank, the special asset division,” he said. “Ultimately, I just don’t want to incur the expense.”

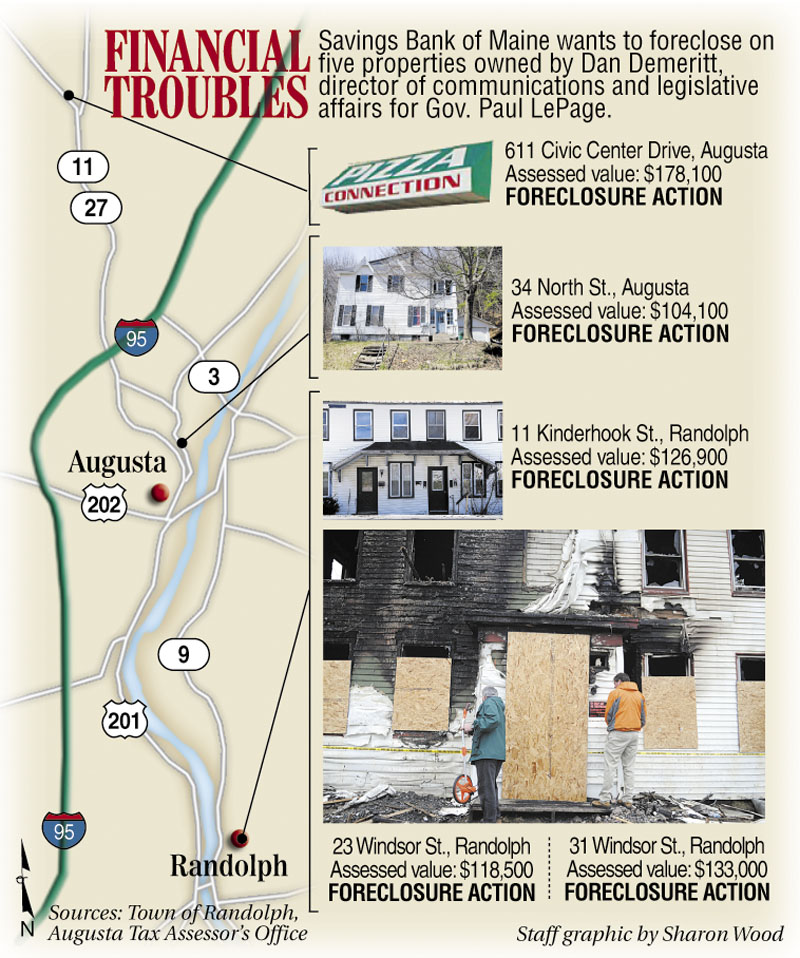

The bank is seeking default foreclosure judgments against Demeritt in Kennebec County Superior Court on properties at 11 Kinderhook and 23 and 31 Windsor streets in Randolph, and a two-family home at 34 North St., Augusta.

The four-unit building at 23 Windsor St. was destroyed by a fire last week that the Office of the State Fire Marshal determined to be arson. No one has been charged with starting the fire. A tenant who escaped currently faces a charge of domestic assault.

For the three-address parcel in Randolph, Demeritt owes $251,191.47 for principal, interest, late charges, tax and insurance advances, and attorneys’ fees. The properties are valued for tax purposes at $378,400, records in Randolph indicate.

For 34 North St., the bank, in an affidavit by vice president Deborah Wallace Howe, claims Demeritt owes $65,837.78 in principal, interest, late charges and attorneys’ fees. That property is valued at $104,100, according to city assessing records.

The bank also has filed foreclosure action to take the 611 Civic Center Drive property in Augusta where Demeritt operates Pizza Connection.

“We were served a summons and complaint about foreclosure action involving Pizza Connection,” said David McCullum, an attorney who serves as clerk for the corporation. “Pizza Connection elected not to file an answer.”

In February 2009, Demeritt obtained a second mortgage of $58,500 on that property from Richard Plourde, of Chelsea. Savings Bank of Maine attorney Richard Currier said he has not filed for default in that case because Plourde had yet to be served notice.

Currier said the absence of a response to foreclosure action is not unusual.

“(People) don’t contest the fact that they’re in arrears,” he said. “Sometimes they just walk away from the property.”

Currier said Demeritt is hardly alone; he said he has filed similar cases against landlords in other parts of the state.

“It’s a very difficult time in our economy, I’m afraid,” Currier said. “The default rate isn’t coming down; it’s going up.”

Currier said the foreclosure cases in progress were filed together in Kennebec County Superior Court because he alleges Demeritt “defaulted on all his loans about the same time.”

In the meantime, Demeritt said Thursday he hopes to sell the pizza business, which remains in operation.

Demeritt closed the Bangor Street Pizza Connection location in October 2010, saying he had been competing against himself “with two Augusta locations separated by about 4 miles.”

Demeritt is likely upside-down on the 611 Civic Center Drive property: According to the court complaint, he owes the bank $182,090.51, including interest and late charges, while the assessed value, according to the city, is $178,100. Assessed values are for tax purposes and often vary significantly from market value.

Records at the city of Augusta assessor’s office show unpaid taxes from two years on that property total $6,217.50. The bank also obtained a default judgment in Augusta District Court last week on equipment at that site.

Interest continues to accrue each day on all the properties.

Demeritt’s property woes don’t end there.

Besides the back taxes owed to the city of Augusta, he also has liens from unpaid sewer bills on the properties subject to the foreclosure action, and faces a lien on an Augusta property at 11 School St. that is not in foreclosure.

Demeritt and his wife, Martha Currier-Demeritt, cleared one lien relatively promptly: On Dec. 7, 2010, they paid $960.14 in unpaid income tax from 2008, clearing a lien Maine Revenue Service had filed against him in 2010.

But the municipal liens have been more durable, with Savings Bank of Maine forced to pay off several of the sewer liens on the Randolph properties.

“Some people go a year or more (before addressing a municipal lien), but most aren’t landlords. Most are homeowners,” Randolph Tax Collector and Treasurer Janet Richards said. “I do have a couple of landlords that go to lien, but most turn around and pay it in a year.”

Richards said back property taxes owed on Demeritt’s properties were recently paid by the bank.

“That’s normal because a municipal lien trumps a mortgage,” Richards said, and a bank looking to take back its asset needs a clear title to do so.

Demeritt — a graduate of Colby College who holds an MBA from the University of Southern Maine — links his unpaid taxes, bills and mortgages to business difficulties that began almost 2 1/2 years ago when he said he leveraged the the value of his properties to buy other properties.

He was forced to close his Bangor Street location after sales dropped off.

“In the fall, right before I came on board with Paul, I had to consolidate” at 611 Civic Center Drive, he said Thursday. “If I hadn’t run into the biggest recession in a couple generations, I would have made it,” he said. “I never, never forecast a 45 percent drop in pizza sales.”

He said he owes money to vendors, including Steve’s Appliance, and when he’s paid every two weeks by the state, he sends checks to pay off those debts.

Demeritt’s salary as director of communications and legislative affairs is $81,536 a year, plus benefits; Currier-Demeritt, an executive secretary to the attorney general, earns $52,041.60 annually, plus benefits, according to the Maine Bureau of Human Resources.

As for being a landlord, Demeritt said, “It’s harder than ever to keep units full with good tenants. There’s more turnover when people leave, more repair costs. I bought the stuff aggressively and they need to operate at a fairly efficient level to service debt and utilities.

“I’m not running away from any of my debts,” he said, adding: “Someday I’m going to take another crack at business again.”

Of the foreclosure proceedings now taking pace against him: “They have to go through the process,” he said. “They’re not able to clear any titles unless they go through the process.”

City Editor Bob Mentzinger contributed to this report.

Betty Adams — 621-5631

badams@centralmaine.com

Send questions/comments to the editors.