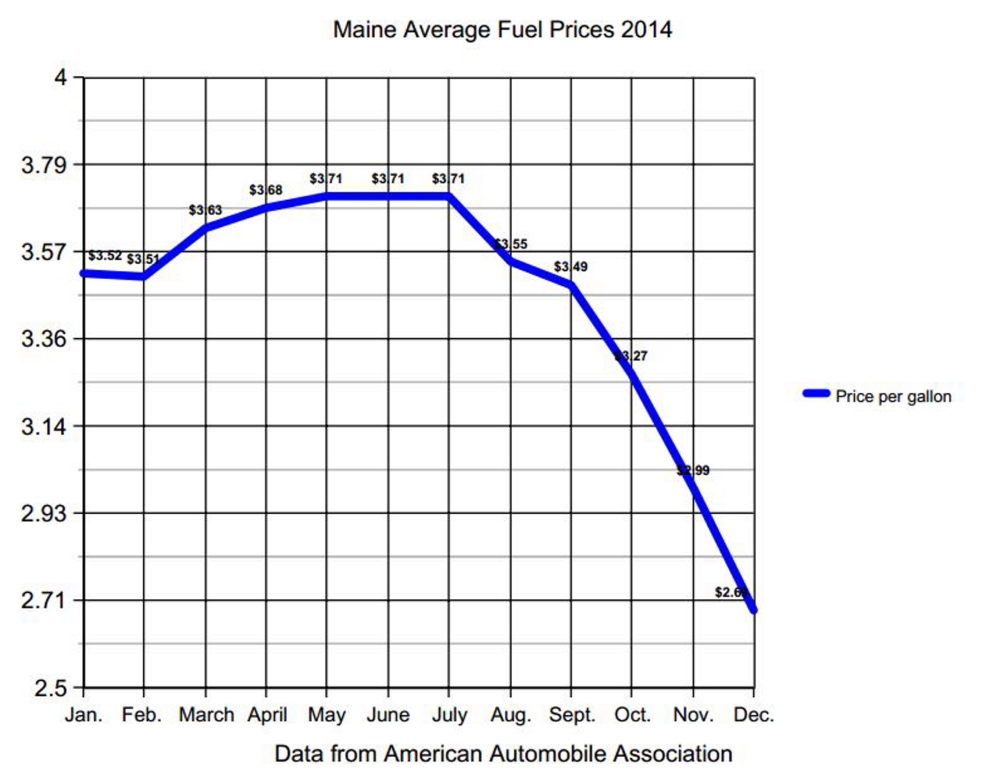

Since peaking in June, the statewide average price for a gallon of regular unleaded gasoline plunged nearly 38 percent recently to $2.32 per gallon.

That’s down a whopping 46 percent from the statewide record high of $4.14 recorded by the American Automobile Association in June 2008.

Consumers in central Maine are enjoying the savings.

“It helps out quite a bit, especially being a college student,” said Thomas College business major Zackary Grote, as he fueled up his car Friday in Waterville.

Grote estimated he is saving between $10 to $15 per tank at current prices, and most of that goes toward paying other bills.

According to an estimate by Wells Fargo Securities published in Business Insider, the bottom 20 percent of U.S. income earners will save $250 more than a year ago if prices remain the same and $814 on average for the top 20 percent of earners, who tend to use more petroleum fuels.

Larger users, including local city governments, are projected to save even more.

“It’s been phenomenal,” said Mark Turner, Waterville’s director of public works.

According to Turner, the city had budgeted 35,000 gallons of diesel fuel at $3.40 per gallon and 12,000 gallons of gasoline at $3.15 per gallon this year. Instead, the city is paying $2.49 per gallon of diesel and $2.07 per gallon of gasoline, both tax free. If prices remain the same, Turner estimates the city will save $45,000 on fuel this year because of dropping prices.

Any money leftover in the city’s budget for fuel when the fiscal year ends June 30 will be rolled back into the city’s general fund and could help stave off future tax increases, Turner said.

The low prices and savings have motorists on the road in increasing numbers. Pat Moody, spokesman for AAA of Northern New England, said they’re predicting a 4 percent increase in driving for Maine and the nation this season compare to last year as well as 0.8 percent increase in air travel as a result of falling fuel prices.

Heating oil prices have also fallen sharply. What cost homeowners $3.81 per gallon at this time last year is currently selling for $2.75, according to prices obtained from the Governor’s Energy Office and the Maine Energy Marketers Association, a trade association representing heating oil, propane and motor fuel sellers.

According to MEMA President Jamie Py, the low oil prices help heating oil companies by reducing their delivery costs. They also decrease the likelihood that homeowners will switch from heating oil to alternatives such as wood pellets or natural gas. Heating a home with oil currently costs about the same or less than heating with natural gas, according to Py.

BUSINESS IMPACT

It is not certain how the reduced fuel prices are impacting local businesses.

Waterville area businesses in general have reported their business revenue is up, but the chamber does not have any studies or evidence to suggest that’s the result of Mainers saving money on energy, according to Kimberly Lindlof, president and CEO of the Mid-Maine Chamber of Commerce in Waterville.

“I can draw that dotted line, but I have no proof that it is up because people have more disposable income,” Lindlof said.

Meanwhile, a sampling of merchants in downtown Waterville yielded mixed responses as to whether overall heating expenses are down and whether reduced oil and gasoline prices are causing shoppers to spend more.

“I can’t say I’ve noticed either, actually,” said Lionel Tardif, owner of L. Tardif Jeweler on Main Street.

The recent Christmas rush also makes it difficult to tell whether reduced fuel prices have led to more customers, Tardif said. If there was an increase in business, he attributed it to Gov. Paul LePage’s policies designed to shrink government spending, not reduced oil and gasoline prices.

Ken Whiting, office manager of Day’s Jewelers in Waterville, gave a similar story: “I think we had a good Christmas. I’m not sure if it’s because of low oil prices though.”

After jewelry sales hit their low in 2010 and 2011, Whiting said, they have been a slow and steady recovery since. Sales still have not returned to their pre-recession levels, he said.

Robert Sezak, owner of RE-BOOKS, a used bookstore in downtown Waterville, said his sales were down and there was no savings on heating costs because he contractually locked his heating oil rates in before prices began declining.

“I think a lot of people are locked in, so they’re not seeing a big increase (of savings) there,” he said.

HOW LONG?

It’s also unclear how long oil prices will remain at their present rates.

In an interview last week with The Detroit News, President Obama cautioned Americans not to “go back to old habits,” because if prices rise again, “you are going to not be real happy.”

Why have prices dropped? A host of factors were involved in the dramatic decline of crude oil prices, according to James Breece, an associate professor of economics at the University of Maine who researches international trade and economic forecasting. First, the increased production of shale oil in North America increased global supplies, and as the economy of China slowed and the economy of Europe entered a period of decline, demand for oil dropped off, Breece said.

Meanwhile, OPEC, which normally controls much of the global oil market, decided not to cut crude oil production in an effort to compete with North American shale oil, which is more expensive to produce, and to ensure they do not lose market share in the future, according to Breece.

Considering the volatility of the oil market, Breece said he would be skeptical of any forecast that predicts exactly when oil prices will rise again and how high they’ll go.

“It’s probably more temporary in the long run,” he said of the low oil prices.

While Breece expects oil prices to climb again as the economies of China and Europe recover, increasing demand, he does not expect them to climb to their previous record levels.

Additionally, he said the production of North American shale oil will help insulate the oil market from the dramatic spikes seen during periods of political unrest in the Middle East.

Domestic oil production has been impacted by OPEC’s decision not to cut production, which has driven prices down.

Breece said oil companies are continuing to produce shale oil, but they have scaled back investments and exploration in North America.

Additionally, in the short term, Moody said AAA expects prices to climb in the spring as refineries switch over to cleaner summer blends in preparation for the busy summer travel season that will increase demand.

Evan Belanger — 861-9239

ebelanger@centralmaine.com

Twitter: @evanbelanger

Send questions/comments to the editors.