Cate Street Capital, the private equity firm that owned the now-defunct Great Northern Paper mill in East Millinocket, is appealing an order by an arbitrator to pay a natural gas company in Boston more than $9 million for not honoring a contract to supply gas to the mill.

The arbitrator, Portland lawyer Peter DeTroy, issued the award on Feb. 4. Cate Street’s attorney, Brian Champion, on April 13 filed an appeal of the decision in Cumberland County Superior Court. The claim was sealed until recently.

Xpress Natural Gas brought the legal claim against Cate Street Capital and GNP Parent LLC in April 2014, three months after the mill had been closed and 200 people laid off. The energy company, which specializes in trucking compressed natural gas to industrial clients in New England that don’t have access to a pipeline, had entered into a contract in September 2012 with GNP Parent to supply compressed natural gas to the mill once it was converted to burn gas in addition to oil. The original contract called for the East Millinocket mill be ready to accept gas in March 2013.

The sales agreement obligated Great Northern to purchase at least 400,000 dekatherms of natural gas per month (a dekatherm is equal to 1 million British Thermal Units), as well as pay back over time certain capital costs incurred by Xpress to install the equipment at the mill to burn natural gas.

Xpress, which has a facility in Baileyville where it draws natural gas from the Maritimes & Northeast pipeline, claimed it spent $4.5 million to purchase equipment necessary to deliver gas to the mill.

In addition, Xpress provided a loan of $1.4 million to GNP Parent, which was guaranteed by Cate Street, to assist in converting the mill to run on gas.

Xpress claimed Cate Street and GNP Parent did not honor the contract and never repaid the loan.

DeTroy found in favor of Xpress, ordering GNP Parent and Cate Street to cover the costs incurred by the energy company, pay back the loan with interest and cover Xpress’ legal fees. In total, the amount is roughly $9 million.

The contract was signed when natural gas was abundant and relatively cheap compared with costs for oil. But increasing demand on a limited supply of natural gas in New England caused prices to spike starting in December 2013 and continuing throughout the 2014 heating season.

PAYING TWICE?

Cate Street’s attorney, Champion, argued in his appeal that the arbitrator awarded Xpress too much money by asking Cate Street to pay a guarantee, as well as the loan itself.

“To the extent that the Arbitrator entered an award against Defendant Cate Street Capital Inc., it is in the nature of a guarantee of payment by Defendant GNP Parent LLC, and is not in addition to those amounts,” wrote Champion, who could not be reached for comment on Wednesday afternoon.

In other words, Champion argued that DeTroy ordered Cate Street to pay twice for the same thing.

Champion also argued that DeTroy overstepped his authority by awarding Xpress certain funds under a guarantee of the sales agreement that had expired in October 2013.

The dispute between Cate Street and Xpress was not part of Great Northern’s bankruptcy proceedings. The gas contract was between Xpress and GNP Parent LLC, which was not involved in the bankruptcy. Two related subsidiaries – GNP Maine Holdings LLC, which owned the mill facility and equipment, and GNP East Inc., which owned the land – filed for bankruptcy in 2014.

The claim was settled in arbitration rather than court because the gas-sales contract requires any disputes or claims to be resolved by binding arbitration rather than the court system.

John Nahill, CEO of Xpress Natural Gas, said Wednesday that his company is continuing to “work amicably” with Cate Street on the unsettled issues related to last year’s sudden closure of the mill. He also said his company is ready to help any new owner interested in restarting the facility.

“Xpress Natural Gas invested heavily in GNP in anticipation of supplying natural gas to the mill,” Nahill wrote in an email. “It is our hope that the mill will re-open in some form with new ownership, and that its displaced workers will have new opportunities. Our company is fully committed to supporting the mill’s revival, and we are confident that natural gas can play an important role.”

CLOSED MILL

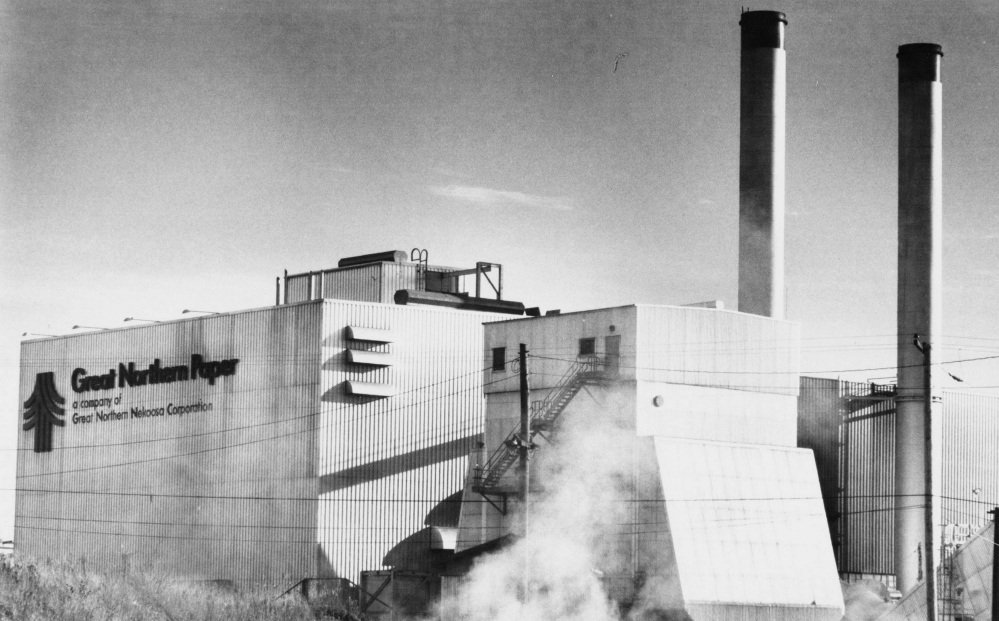

Cate Street acquired the mill in East Millinocket, as well as its sister mill in Millinocket, in 2011 for $1 from Brookfield Asset Management of Canada. It reopened the mill and rehired roughly 200 people who had been laid off by the previous owner.

Cate Street claims it invested roughly $32 million in the mill through late 2012, when it received what was purported to be a $40 million loan from out-of-state investors under the Maine New Markets Capital Investment program. However, a recent Maine Sunday Telegram investigation revealed that the deal did not supply the mill with $40 million in capital to invest in the mill. The majority of those funds were returned in the same day as part of a financing tool called a one-day loan. GNP Maine Holdings, the subsidiary that received the investment, was left with $8 million, which was used to pay off an existing loan and to pay fees and closing costs. Because the investment deal was performed under the Maine New Markets program, Maine taxpayers will provide the investors with $16 million in refundable tax credits over the next five years.

GNP Maine Holdings LLC and GNP East Inc., the Cate Street subsidiaries that owned the mill facility and the land in East Millinocket, both filed for bankruptcy last year with more than $60 million in unpaid bills.

The mill facility was sold at auction in early December 2014 for $5.4 million. The buyer, Hackman Capital Acquisition of Los Angeles, continues to market the facility to industrial users.

Send questions/comments to the editors.