Maine’s investment community was unfazed Monday by a major market sell-off, seeing the turmoil on Wall Street as an opportunity.

The Dow Jones industrial average plunged nearly 600 points Monday, a 3.56 percent drop, while the S&P fell nearly 78 points, or 3.94 percent, caused by worries that growth of the Chinese economy could be stalling. It was the second straight trading day that the Dow lost more than 500 points. It fell 531 points on Friday after dropping by 358 the day before.

Among those watching international markets is Sandra Matheson, executive director of the Maine Public Employees Retirement System’s pension fund, which lost $150 million on Friday, falling from a total value of $12.3 billion to $12.16 billion. She did not have the numbers for Monday’s losses.

Although the size of the loss might make someone gasp, it represents roughly 1.2 percent of the plan’s value. MainePERS covers about 100,000 active and retired state employees. Last year the plan earned a return of 16.7 percent, besting Standard & Poor’s average of 13.9 percent.

“Whenever the markets are troubled like they are right now, we watch them very closely,” Matheson said Monday. “But we’re long-term investors and set our asset allocation factoring in the potential for market ups and downs.”

In other words, “we do not adjust our investment strategy on a daily basis,” she said.

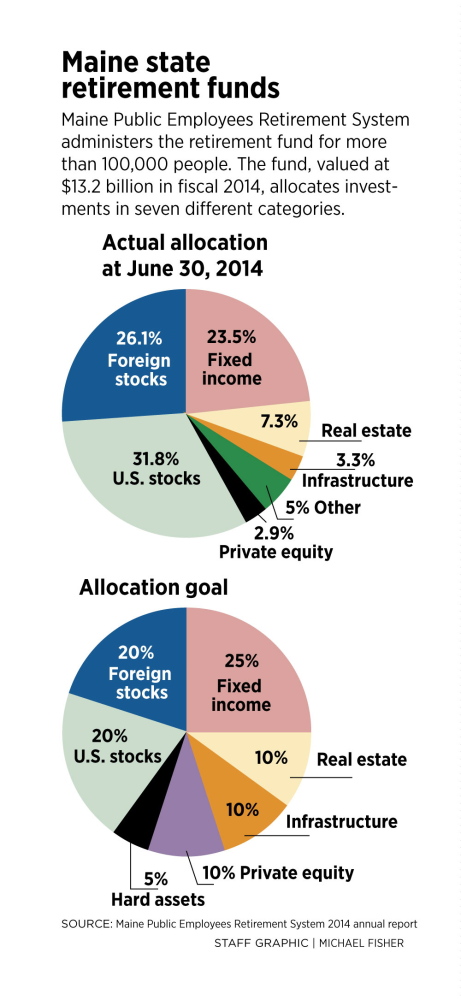

In the past five years, the pension fund has been “balancing risk and returns” by diversifying its portfolio, Matheson said. Before 2009, the majority of the fund’s investments were in public equities and fixed assets. It has since been diverting into alternative investments such as private equity funds and real estate.

The goal is to reduce exposure in stocks by shifting the mix so that 20 percent of the portfolio is invested in domestic stocks and 20 percent in foreign stocks. Last year the ratio was 31.8 percent in domestic stocks and 26.1 percent in foreign stocks.

“We found a diversified portfolio of alternative and fixed assets and public equities was the best asset allocation,” Matheson said.

Her colleagues in private investment companies expressed similar calm.

Instead of inducing panic, this type of market event offers investors excellent opportunities, said Dan Lay, managing director at H.M. Payson, a Portland-based investment management company.

“When we get a day like today we try to be opportunistic and pick up companies that are high-quality dividend payers and growers,” Lay said. “When we get opportunities like this, we get excited to put cash to work on behalf of clients.”

Still, he expects some clients to worry after reading news headlines about a global market meltdown. He had fielded three calls as of Monday afternoon from worried clients, fewer than he expected.

The market sell-off began last week after Chinese stocks began to tumble. That, coupled with the Chinese government’s recent devaluation of its currency, has led market participants to worry that China’s economy is not growing at as fast a clip as projected.

Such worries are nothing new, though, said Jessamyn Norton, chief investment officer for Spinnaker Trust, a Portland-based investment firm that manages more than $1.2 billion for roughly 300 clients.

“People have been on edge about China for several years,” Norton said Monday afternoon.

After the global recession late last decade, the Chinese government spent loads of money on infrastructure projects and social programs with little to no return potential. People have been expecting that to come back to haunt them, Norton said, and some people have been worried about a “hard landing.”

That’s not what this is, Norton said, but enough has happened to make people worried. The fact that many people were on vacation and returned Monday to market turmoil could also have contributed to the “knee-jerk reactions,” she said.

Going forward, no one knows what to expect from the markets – “anyone who tells you where the market is going doesn’t know what they’re talking about,” Lay said – but a focus on the long game means not getting spooked by the daily throes of the market.

“We’ve been through a lot worse than this,” Lay said, noting that H.M. Payson has been around since 1854. “Market movements like this don’t tend to rattle us.”

Send questions/comments to the editors.