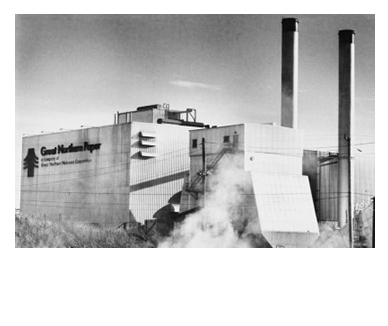

The 2014 closure of the Great Northern paper mill in East Millinocket was a double disaster.

Not only did northern Maine lose a major employer in an economically stressed region, but it was also fleeced by out-of-state investment bankers.

State funds that were intended to boost economic growth in low-income communities here are instead being shipped to high-rent districts elsewhere. Because of a flaw in the state’s New Markets tax credit program, financiers were able to qualify for a $16 million match from the state by borrowing money.

The loan was returned the next day, but Maine taxpayers stayed on the hook for their share even after the mill shut down. The state will continue to pay off the refundable tax credits for years, while the people of the Katahdin region struggle to make a living.

It is not possible to turn back the clock, but at least one state agency has taken steps to make sure it doesn’t happen again. After earlier attempts to address the issue stalled in the Legislature, the Finance Authority of Maine has made an emergency rule change to ensure that before it pays for an incentive to attract investment in low-income Maine communities, there is actually investment in those communities.

The new rule prevents the issuance of tax credits for any investment where more than 5 percent of the money is used to refinance prior loans, to make equity distributions, to acquire an existing business or to pay transaction fees. In effect, the language aims to ensure that the investment is actually spent to benefit the low-income community. “The heart of this whole issue is to ensure the low-income community business gets the full investment to justify the tax credit,” said Bruce Wagner, FAME’s CEO. “That language does that.”

Unfortunately, a similar rule was stripped from the original law, after a private equity firm threatened to back out of $30 million in Maine investments. That firm, Advantage Capital of New Orleans, proceed to qualify for Maine tax credits with an investment inflated by a one-day loan.

The New Markets tax credit program is just one of 59 economic development incentive programs that cost the state nearly $300 million a year, according to the Office of Program Evaluation and Accountability, the state’s watchdog agency.

How effective the programs are is anybody’s guess. Department of Economic and Community Development Commissioner George Gervais told the Legislature’s Government Oversight Committee earlier this month that his department lacks the resources to evaluate the programs, and even if it did, he said he thought that his agency should be more of a cheerleader for business than a regulatory agency.

The Great Northern debacle shows where too much cheerleading will get you. There are no doubt successful tax credit programs, even successful transactions in the New Markets program, but Maine can’t afford a reputation for paying to attract investments that never materialize.

FAME’s board should be applauded for closing this door, but it would be better if the official in charge of these programs were looking for other vulnerable spots that need attention.

Send questions/comments to the editors.