More Maine seniors are living in poverty than previously thought, but that is merely a teaser for the crisis the state faces as baby boomers reach retirement age by the thousands.

Too many boomers are ill-prepared for old age, and will find themselves struggling to get by once they can no longer work.

That will hit Maine, where baby boomers make up 29 percent of the population, harder than most, and makes it imperative the state adopts policies that lower living costs for seniors, and supports the strengthening of Social Security.

The collaboration and education underway at the Maine Summit on Aging, the second of which was held last week in Augusta, is a good start.

STRUGGLING SENIORS

At the Sept. 14 event, a pair of researchers demonstrated how the official poverty measurement, based strictly on income, does not accurately reflect how many seniors are living lives of scarcity.

To get a truer picture, the researchers instead used the Supplemental Poverty Measure, which takes into account the hefty out-of-pocket medical costs that most seniors have (as well as tax liability and in-kind benefits such as food stamps.)

That formula puts a full 10 percent of Maine seniors under the poverty line, 2.3 percentage points more than with the standard measurement.

Even that doesn’t tell the full story.

The poverty line is very low — $15,930 annually for a two-person household.

A full 40 percent of Maine residents age 65 and older live on incomes that are less than twice the poverty level, which is barely enough to make ends meet, and not sufficient to feel any sort of financial security.

And that number likely will get worse in the coming years.

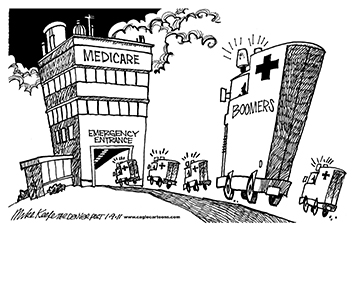

BOOMER BUBBLE

Baby boomers in Maine are hitting retirement age at the rate of 18,250 per year, whether or not they are ready to stop working.

With inadequate or nonexistent retirement funds, little to no savings, and an overreliance on Social Security — not to mention longer life spans — most are not.

An estimated 75 percent of Americans nearing retirement in 2010 had less than $30,000 in retirement accounts. Almost a third have no retirement funds set aside at all.

It’s not the fault of poor planning; older boomers have spent the final 30 years of their working life dealing with stagnant wages, disappearing pensions and skyrocketing costs in health care and education, capped off by the largest economic downturn in decades.

As a result, on average, the first wave of boomer retirees face a shortfall of more than $70,000 per individual.

That will have widespread implications for Maine, where by 2030 more than a quarter of residents will be 65 or older.

Those who can will work longer in order to make their retirement funds last.

But eventually, failing health, and the lack of both employment opportunities and sufficient retirement funds will catch up to a great number of these seniors.

Without help, the seniors, many formerly middle-class workers, will spend their later years experiencing the desperation and uncertainty of poverty and near-poverty.

STAYING AFLOAT

Letting that go unaddressed would be a massive drag on Maine, not to mention a moral failing on the part of the state.

The situation cries out for initiatives, such as the housing bond on the November ballot, that create affordable housing for seniors, as well as reliable programs that provide inexpensive in-home health support and alternative transportation.

But more than that, it is essential to protect and even expand the safety net that has kept millions of seniors out of poverty.

Social Security alone keeps half of seniors from living below the poverty line, and Supplemental Security Income, Medicaid and Medicare play a significant role as well.

Without these programs at their fullest, seniors, and a good portion of Maine’s population, will suffer.

Send questions/comments to the editors.