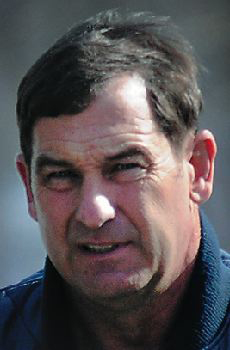

Marshall Swan is working as a “town driver,” driving the trash truck, minibus and various pickup trucks at the Federal Medical Center in Devens, Massachusetts, and he’s helping new inmates adjust to life within the walls.

However, those good works aren’t enough to get the Chelsea man out of there earlier than his anticipated release date of Oct. 22.

Swan, 58, was convicted in October 2013 by a jury in U.S. District Court in Bangor of falsifying five years’ worth of income tax returns and failing to report some $650,000 in income between 2006 and 2010. On June 2, 2014, he was sentenced to 33 months in prison.

In a decision issued Feb. 10, the sentencing judge rejected Swan’s appeal to be freed sooner.

Swan had said in pleadings he filed on his own behalf that being released even a few months earlier than scheduled would allow him to “return to and save” his family construction business, currently being operated by his older son with help from his younger son, a college student.

“However, the nature of the business was work for clients based on my personal relationships over many years,” Swan wrote in an affidavit dated Jan. 7. “In my absence the business has suffered over the loss of the personal contacts and relationship. I appreciate that any reduction in sentence will not be significant. However, any extra time home that will allow me (to) return to and save the family business might make a difference.”

U.S. District Court Judge John A. Woodcock ruled that Swan was ineligible for a reduction in his sentence under recently amended U.S. Sentencing Commission Guidelines governing tax losses. However, Woodcock acknowledged strides made by Swan even as the judge rejected that basis for a reduction.

“The Court is gratified to learn from Mr. Swan that he has done well in prison, that he has taken advantage of rehabilitation opportunities, that he has been designated as a town driver, and that he has assisted new inmates. … The Court regrets the impact that his incarceration is having on his business. … Nevertheless, except for highly unusual circumstances not present here, the law does not allow a sentencing judge to reduce a sentence based on a defendant’s rehabilitation in prison.”

Efforts to reach Swan and/or his counselor at the prison by phone on Wednesday and Friday proved unsuccessful.

The prison term was at the top end of the federal sentencing guidelines in Marshall Swan’s case, and only three months shorter than that sought by the prosecutor, Assistant U.S. Attorney Donald Clark, who told the judge the tax evasion was a case of “unconscionable greed.”

Swan said in his pleadings that in the prison he has earned the “lowest level risk assessment and trust” and that he has availed himself of numerous educational opportunities.

Swan paid the $145,000 in back taxes he and his wife owed, plus his $40,000 fine and $500 in court assessments. Once he is freed from prison, he will spend one year on federal supervised release.

Swan’s wife, Carole, who spent 19 years on the Board of Selectmen in Chelsea, also was convicted of the same income tax fraud charges as her husband, as well as three counts of extortion. She was found guilty of using her position as a selectwoman to seek kickbacks from Frank Monroe, of Whitefield, in exchange for his keeping a contract with the town of Chelsea, and of defrauding the federal workers’ compensation system for two years of benefits.

She was acquitted of alleged fraud in connection with a $396,880 town project to replace the Windsor Road culvert in 2007, as well as two additional counts of defrauding the federal workers’ compensation system.

The accusations against Carole Swan deeply divided the residents of Chelsea and led to an upheaval among town employees and town officials.

Carole Swan, 57, is at the Federal Correctional Institution in Danbury, Connecticut, serving an 87-month term. Her release date is currently Dec. 6, 2020.

Shortly before she began her sentence, she finished paying $232,346.94 in court-ordered fines and restitution.

In September 2015, an appeals court in Boston heard her attorney argue that Carole Swan should receive new trials because of the manner in which she was questioned on Feb. 3, 2011, by two Kennebec County sheriff’s deputies. That questioning was a captured on videotape and portions of it were played at trial. An assistant U.S. attorney argued that the questioning was proper and urged the judges to uphold a suppression ruling by a federal magistrate judge.

A decision has yet to be issued in that case.

Betty Adams — 621-5631

Twitter: @betadams

Send questions/comments to the editors.